Unlocking the Power of 5starsstocks.com Passive Stocks: Your Gateway to Steady Wealth Growth

Investing is sometimes seen as dealing with a tough maze with lots of uncertainty, big changes and the need to decide on actions at the right moment. Anyone wanting to invest with less effort can explore the passive stocks on the 5starsstocks.com website. With these stocks, investors can build their wealth step by step, without much stress, by backing consistent top performers in important sectors.

We’ll examine 5starsstocks.com passive stocks in this article, ranging from top companies to new sectors such as cannabis and lithium. We will also explain why owning staples, healthcare, materials and defense stocks is important in a portfolio, especially if you are looking for safe and simple investments you don’t have to watch often.

What Are 5starsstocks.com Passive Stocks?

You should become familiar with what passive stocks mean before you move into specific sectors. Unlike continuously trading, where you regularly buy and sell, passive investing means you pick quality stocks and let them do their job with little intervention. These stocks generally:

- Provide consistent dividends

- Exhibit lower volatility

- Represent established companies with proven track records

At 5starsstocks.com, we select passively managed stocks to help you achieve stability and success over the long run. If you’re looking to increase your wealth over time, but don’t want to closely watch your portfolio each day, this could be a great strategy for you.

Why Choose 5starsstocks.com Passive Stocks?

Having passive stocks from 5starsstocks.com gives you security and the chance for increased returns. This is what makes them worth noting.

- Steady Returns Over Time: These stocks prioritize stability, providing steady dividends and consistent gains.

- Diversification Opportunities: Investing across sectors like staples, healthcare, and defense spreads risk.

- Lower Stress and Time Commitment: Unlike day trading, passive investing allows you to set it and forget it.

- Access to High-Quality Companies: 5starsstocks.com rigorously evaluates companies based on financial health, market position, and growth prospects.

- Alignment with Growth Trends: With emerging sectors like lithium and cannabis included, investors can ride new waves of innovation.

Diving Deep: The Core Sectors of 5starsstocks.com Passive Stocks

1. 5starsstocks.com Blue Chip Stocks: The Bedrock of Your Portfolio

Blue chip stocks have long been the foundation of passive investing. These are shares in large, reputable companies with a history of stable earnings and dividend payments. On 5starsstocks.com, blue chip stocks provide:

- Stability during market downturns

- Reliable dividend income

- Long-term capital appreciation

Companies in this category often dominate their industries and serve as economic bellwethers. For investors focused on steady growth and risk management, 5starsstocks.com blue chip stocks form an essential part of any passive strategy.

2. 5starsstocks.com Staples: Consistent Performers in Any Economy

Staples are companies that produce essential goods—think food, household items, and personal care products. These businesses typically see stable demand regardless of economic cycles, making 5starsstocks.com staples some of the most dependable passive stocks.

Investing in staples means putting your money into companies with:

- Strong cash flow

- Predictable earnings

- Resilience during recessions

Their steady performance can cushion your portfolio when more volatile sectors struggle.

3. 5starsstocks.com Healthcare: Innovation Meets Stability

Healthcare remains one of the fastest-growing and most vital sectors globally. The rising demand for medical services, pharmaceuticals, and biotechnology innovation creates excellent opportunities.

5starsstocks.com healthcare stocks combine the stability of established pharmaceutical giants with the growth potential of cutting-edge biotech firms. This blend makes healthcare a cornerstone of a diversified passive stock portfolio, especially given:

- Aging populations worldwide

- Increasing healthcare spending

- Continuous innovation in treatments and technology

4. 5starsstocks.com Materials and Lithium: Mining Growth Opportunities

Materials companies extract and process raw materials essential for manufacturing and technology. In particular, 5starsstocks.com materials stocks include leaders in metals, chemicals, and mining industries.

A special highlight is 5starsstocks.com lithium stocks, as lithium powers batteries for electric vehicles and renewable energy storage. The surge in demand for clean energy solutions has made lithium one of the hottest commodities in recent years.

Investing in materials and lithium stocks offers:

- Exposure to global industrial growth

- Long-term demand linked to sustainability trends

- Potential for strong capital gains in emerging sectors

5. 5starsstocks.com Cannabis: A Budding Industry for Growth

The cannabis industry is rapidly evolving, shifting from a niche market to a mainstream economic force. With increasing legalization and medical acceptance, 5starsstocks.com cannabis stocks offer investors a chance to get in early on what could be a multi-billion-dollar sector.

The cannabis sector blends high growth potential with risks that require careful stock selection—something 5starsstocks.com addresses by analyzing companies with solid fundamentals and market leadership.

6. 5starsstocks.com Defense: Stability Through National Security

Defense stocks provide an often-overlooked avenue for passive investing. Governments consistently allocate substantial budgets to defense, supporting companies that manufacture weapons, technology, and infrastructure.

5starsstocks.com defense stocks often exhibit strong dividends and steady revenue streams. This sector is especially attractive for investors seeking:

- Stability amid geopolitical uncertainties

- Companies with long-term government contracts

- Solid dividend yields

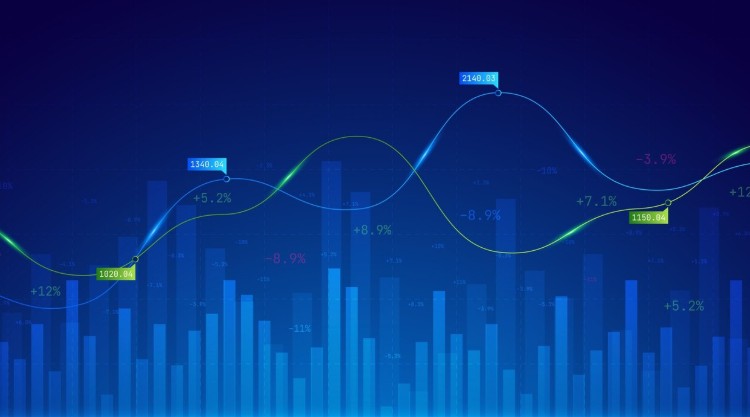

How to Build a Balanced Portfolio with 5starsstocks.com Passive Stocks

To maximize returns while minimizing risk, diversification across sectors is key. A balanced portfolio on 5starsstocks.com might look like:

- 40% in blue chip stocks for stability

- 20% in staples for recession-proof income

- 15% in healthcare for growth and innovation

- 10% in materials and lithium for industrial exposure

- 10% in cannabis for emerging market potential

- 5% in defense for stable income and risk mitigation

This mix combines the safety of traditional industries with the excitement of new markets, creating a portfolio that can weather market fluctuations.

The Long-Term Benefits of Investing in 5starsstocks.com Best Stocks

Investors often ask: Why hold onto stocks instead of trading them? The answer lies in the power of compounding and patience.

5starsstocks.com best stocks offer long-term growth and dividends, which, when reinvested, can grow exponentially over decades. Passive investing eliminates the emotional rollercoaster and capitalizes on market growth over time.

Many successful investors attribute their wealth to simply holding high-quality stocks through market ups and downs—a principle that 5starsstocks.com passive stocks perfectly embody.

Frequently Asked Questions About 5starsstocks.com Passive Stocks

Q1: Are 5starsstocks.com passive stocks suitable for beginners?

Absolutely. Their stability and steady growth make them ideal for investors new to the market.

Q2: How often should I check my portfolio?

Passive investing means less frequent monitoring. Quarterly or biannual reviews are sufficient.

Q3: Can I invest in 5starsstocks.com lithium stocks if I’m risk-averse?

Lithium stocks have higher volatility but great growth potential. Balance them with blue chip and staples for risk management.

Conclusion

For investors seeking growth without the chaos of active trading, 5starsstocks.com passive stocks present a compelling opportunity. From reliable blue chips and staples to dynamic sectors like lithium and cannabis, this platform offers a diverse range of investments tailored for long-term success.

Incorporating 5starsstocks.com healthcare, materials, and defense stocks adds layers of stability and growth potential. By strategically balancing your portfolio, you can harness the full power of passive investing and build wealth steadily, securely, and smartly.

Start your journey today with 5starsstocks.com passive stocks, and take advantage of a proven, effective approach to growing your financial future.

For more information visit our site.